Investor Awareness

What is a Mutual Fund?

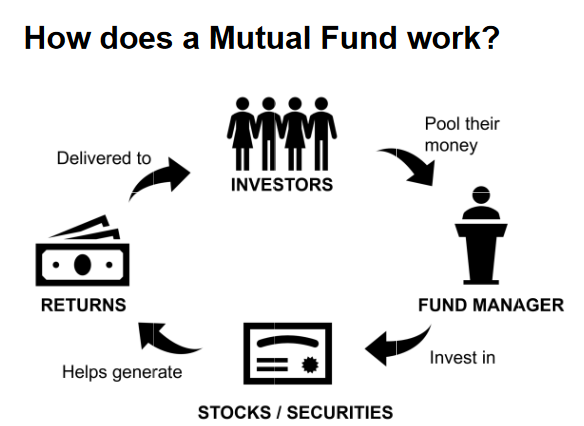

- A mutual fund is the trust that pools the savings of a number of investors who share a common financial goal.

- Anybody with an investible surplus of as little as a few hundred rupees can invest in Mutual Funds.

- Money collected is invested by a professional fund manager in different types of securities.

- Securities could range from shares to debenture, from Government Bond to money market instruments, depending upon the scheme’s stated objective.

- Mutual Fund investment gives the market returns and not assured returns.

- In the long term market returns have the potential to perform better than other assured return products.

- Investment in Mutual Fund is the most cost efficient as it offers the lowest charge to the investor.

Categorization of Mutual Fund Schemes

As per SEBI guidelines on Categorization and Rationalization of schemes issued in October 2017, mutual fund schemes are classified as –

- Equity Schemes

- Debt Schemes

- Hybrid Schemes

- Solution Oriented Schemes – For Retirement and Children

- Other Schemes – Index Funds & ETFs and Fund of Funds.

- Under Equity category, Large, Mid and Small cap stocks have now been defined.

- Naming convention of the schemes, especially debt schemes, as per the risk level of underlying portfolio (e.g., Credit Opportunity Fund is now called Credit Risk Fund)

- Balanced / Hybrid funds are further categorized into conservative hybrid fund, balanced hybrid fund and aggressive hybrid fund etc.